Investing in cities for the future

Across most of the globe, population is expected to continue growing exponentially, although this is less so in Europe, which has a declining yet ageing population.

According to the UN, most of the change in Europe will have to take place in an integrated, affordable and sustainable fashion within pre-existing urban fabric.

Most European cities are expected to cover greater areas than in the past, and cities will have to increasingly recognise the importance of optimising how their public space is both designed and used.

An ageing EU population will require the further adaptation of infrastructure and services.

More generally, the world cities will increasingly apply new technologies and innovation across a wide range of sectors, from transport and mobility to citizen engagement.

This technology will need to be integrated and interoperable – meaning different types of technology that speak to each other.

Cities, particularly those that are likely to see a population explosion, will need to cope with existing major issues such as providing sufficient affordable housing to an increasingly varied population, ensuring inclusiveness and reducing environmental impacts.

The challenges and opportunities for cities in the not too distant future will be explored in this report, which comes with 30 minutes of CPD.

Residential the most favoured property type by advisers

Residential and industrial facilities are among the property types advisers are most likely to increase their client's exposure to over the next 12 months, according to an FTAdviser poll.

When asked about the property types they favoured, a third (33.3 per cent) said residential, 26.7 per cent said industrial facilities, while 20 per cent said warehouses.

Some 13 per cent said warehouses, while only 6 per cent said they would consider increasing exposure in shopping centres.

Shopping centres have struggled in recent years due to the rise of online shopping, a trend that accelerated during the Covid-19 lockdowns and has carried on.

More than 8,700 chain stores disappeared from UK’s retail locations in the first six months of 2021.

In total, 3,488 shops opened, compared to 8,739 closures, creating a net decline of 5,251, according to PwC research compiled by the Local Data Company.

Environmental, social and governance factors

When it comes to ESG performance, industrial properties are leading the way in commercial real estate, globally, according to a study by Deepki, an ESG intelligence business.

A recent survey of 250 European pension fund managers in the UK, Germany, France, Spain and Italy, with a combined AUM of €402bn (£347bn), shows that across different segments of the real estate sector, industrial properties such as warehouses and manufacturing sites lead the way when it comes to ESG performance.

The report asked respondents to rate the performance of eight commercial property sectors.

Two-thirds (62 per cent) rated the ESG performance of the industrial sector as good or very good, followed by leisure (61 per cent), and retail (60 per cent).

This compares to logistics and office real estate, which had the lowest ‘positive’ rating of 47 per cent and 44 per cent respectively.

Future-proofing cities' property

Cities account for less than 2 per cent of the planet’s surface but produce more than 60 per cent of greenhouse gas emissions, according to figures from UN Habitat.

With ‘building better cities’ among its sustainable investment themes, Peter Michaelis, Liontrust’s head of sustainable investment, says it is based on “fairly alarming” figures, but adds therein lies the opportunity.

“The driver behind our ‘building better cities’ theme focuses both on developing current infrastructure to make it more efficient, and improving what has gone before when building new urban areas.

"Many developed world cities will have to invest in some retrofitting to limit environmental impacts."

Developed vs emerging cities

Also distinguishing between developed and emerging market cities is Jean-Charles Sambor, BNP Paribas Sustainable Asian Cities fund manager, who says the pandemic has widened the disparity between the two.

“In developed market cities such as London, Paris or New York, people have become used to a hybrid system of working remotely outside the city for part of the time, and travelling into the city once or twice a week.

“However, this is not the case in emerging market cities such as Bangkok, Manila or New Delhi, which are continuing to see inward migration as they still present better opportunities for prosperity within their own countries.”

Although some people decided to leave city centres as a result of the pandemic, Florent Eyroulet, portfolio manager of DNCA Invest Euro Smart Cities, says the shift has not been seismic.

Many developed world cities will have to invest in some retrofitting to limit environmental impacts

Eyroulet notes how more than 80 per cent of global GDP is generated in cities, and that urbanisation creates a number of investment opportunities.

“Mass urbanisation is driving interesting investment opportunities in companies providing solutions to various social and environmental challenges such as climate change, air pollution and ageing infrastructure.”

The UN also highlights a further challenge, in that another 2.5bn people are projected to live in urban areas by 2050, with the majority in Asian and African cities.

Reducing inefficiencies that come with growth, such as traffic congestion and pollution, will require reassessment of urban development and the introduction of new technologies and services, says Omar Moufti, a product strategist for thematic and sector ETFs at BlackRock, whose funds include the iShares Smart City Infrastructure UCITS ETF.

“Companies focusing on providing services for development and efficient running of cities in a sustainable manner will be well positioned to benefit from this trend.

"Opportunities abound, from equipment manufacturers and service providers improving resource efficiency such as water, energy and waste, to real estate development and renovation.”

>Buildings accounted for 36 per cent of global energy demand and 37 per cent of energy-related CO2 emissions in 2020.

In terms of the carbon impact of real estate, Sambor at BNP Paribas Asset Management breaks this down into three phases of design, build and usage.

He adds: “The proceeds of green bonds issued by real estate developers are mostly destined for ‘green buildings’ that are designed with best practices across various areas, such as energy use, water efficiency or quality of indoor space.

“We look for real estate developers who are implementing best practices in the build phase, such as using lower carbon concrete or steel, or using biodiesel to power construction machinery.

“Some green bond proceeds are also used for implementing individual measures to improve energy efficiency during usage, such as replacing existing lighting to be more energy efficient, or improving glass insulation.”

Indeed, Claus Mathisen, chief executive of real estate investor NREP, says current conversation is fixed on preserving the value of buildings to avoid the risks of inaction: “This is supported by growing evidence of a green premium, where sustainable buildings are valued higher.”

While investment opportunities for building new, operationally energy-efficient assets have risen, Bill Hughes, LGIM global head of real assets, adds that what must not be forgotten is the existing opportunity in retrofitting.

“Most of the UK's buildings will still be in use by 2050, so the scale of investment needed to make them fit for the future is substantial," Hughes adds.

The proceeds of green bonds issued by real estate developers are mostly destined for ‘green buildings’ that are designed with best practices across various areas, such as energy use, water efficiency or quality of indoor space

"As real assets owners, we have a responsibility to future-proof our investments, to ensure they are resilient and adaptable to both climate-related transition and physical risks.”

The rise of ecommerce

The popularity of online shopping has also created investment opportunities in real estate, as Matthew Norris, Gravis director of real estate securities, notes how the long-term trend towards increasing ecommerce penetration and same or next day delivery services was accelerated by the pandemic.

“[This] has increased the demand for ‘last touch’ logistics space,” says Norris, relating to the final stage of a delivery journey from a distribution centre to the customer.

“Over the past decade or more, the supply of this type of warehouse space with proximity to cities has shrunk. It has been demolished and replaced by residential buildings.”

The concentrated growth of ecommerce during the first lockdown underpins the increased attractiveness of urban logistics assets, says Hughes at LGIM.

“With a scarcity of high-quality, well-located industrial assets, the supply/demand imbalance is significant. This presents a compelling investment proposition.”

Also noting higher demand for urban and last mile logistics space to service large towns and cities is Henry Pepper, a partner at Bridges Fund Management that specialises in sustainable and impact investing, who says it has invested in a number of sites.

He says: “Working alongside specialist joint venture partners, we’re designing and developing some of the most sustainable industrial buildings in the country, including some that are net-zero carbon in construction and operation.”

Pepper adds that sites are increasingly designed to support electric vehicles, which tends to make buildings more attractive to occupiers and investors looking to future-proof their real estate portfolios.

When it comes to real estate investment, Lisette van Doorn, chief executive of Urban Land Institute Europe, says its definition will continue to change beyond a building with a tenant and a contract, with location and future flexibility entering the equation.

Doorn says: “The pandemic has played an important role in that. We don’t think about going back to the office anymore as we did before, so what does that mean? It’s maybe not necessarily less office space, it’s very different office space where people can meet.”

In February 2022, 84 per cent of workers who had to work from home because of Covid said they planned to carry out a mix of working at home and in their place of work in the future.

The proportion of people hybrid working has risen this year, according to the Office for National Statistics. But Arnaud du Plessis, CPR Asset Management’s Future Cities fund manager, says he does not yet see any significant impact of home-working on the occupancy rate of commercial property.

He adds: “It is rather the form of commercial buildings that changes, with the development of the ‘flex office’ for example. Office spaces are being redefined. The number of individual workstations will decrease but not the size of office buildings, because other kinds of spaces will be substituted for them.”

Ivo Weinöhrl, a senior investment manager for the Smart City strategy in Pictet Asset Management’s thematic equities team, agrees: “In terms of office space, while many feared a massive oversupply going forward due to reduced space needs, this has not happened in a major way, yet.

“However, there has been a strong flight to quality, ie high demand for newer office space at prime locations with strong environmental credentials. The opposite is happening at secondary locations or with older space that needs renovation. One possible explanation is that this is an attempt to lure people back to the office by employers.”

Despite the pandemic, Niall Gaffney, chief executive of IPUT, which owns offices and logistics assets in Dublin, says its investment strategy has remained consistent. But he adds its focus on place-making, which IPUT describes as creating more attractive places for people who live and work where it invests, has become more relevant over the past two years.

“We believe that the evolving hybrid working debate reinforces the need to make cities and offices more attractive and vibrant places to live, work and play, and place-making is at the heart of that evolution,” says Gaffney.

Although home-working has become more common, Sambor at BNP Paribas says he views the trend being more relevant to developed markets.

He adds: “It is more relevant where there are good home-working conditions: good access to technology, good IT infrastructure and a home fit for work.

“In addition, working from home is more oriented towards economies more dominated by service sectors, which is not the case for the vast majority of emerging markets.”

Almost the entire global population (99 per cent) breathes air that exceeds WHO air quality limits and threatens their health.

While home-working may be more prevalent in developed markets, a common feature of many cities is air pollution.

Air quality is a potential investment opportunity when thinking about future cities, says Kate Elliot, Rathbone Greenbank’s head of ethical, sustainable and impact research, with premature deaths from air pollution concentrated in urban areas, low and middle income countries.

“Given global demographic trends of population growth in low and middle income countries, and greater urbanisation globally, this problem is expected to worsen over time.

“Early action to measure and manage environmental health issues is therefore key. We see opportunities in sensor technology that provides a more accurate understanding of where the air pollution is and the hotspots that can form.”

But building better cities is not just about adapting to climate change, reminds Michaelis at Liontrust, who adds they should also be designed to ensure the benefits of urbanisation are inclusive.

He says: “Policies to manage urban growth need to support access to infrastructure and social services for all, focusing on the needs of everyone for housing, education, healthcare, decent work and a safe environment.”

Safe as houses: the inflation-busting benefits of investing in property

Although residential property can be a sound investment, it is also one of life’s essentials. Everyone needs somewhere to live.

It is this basic human necessity that is the reason why housing is included – along with transportation and food – as one of the three largest components of the US CPI.

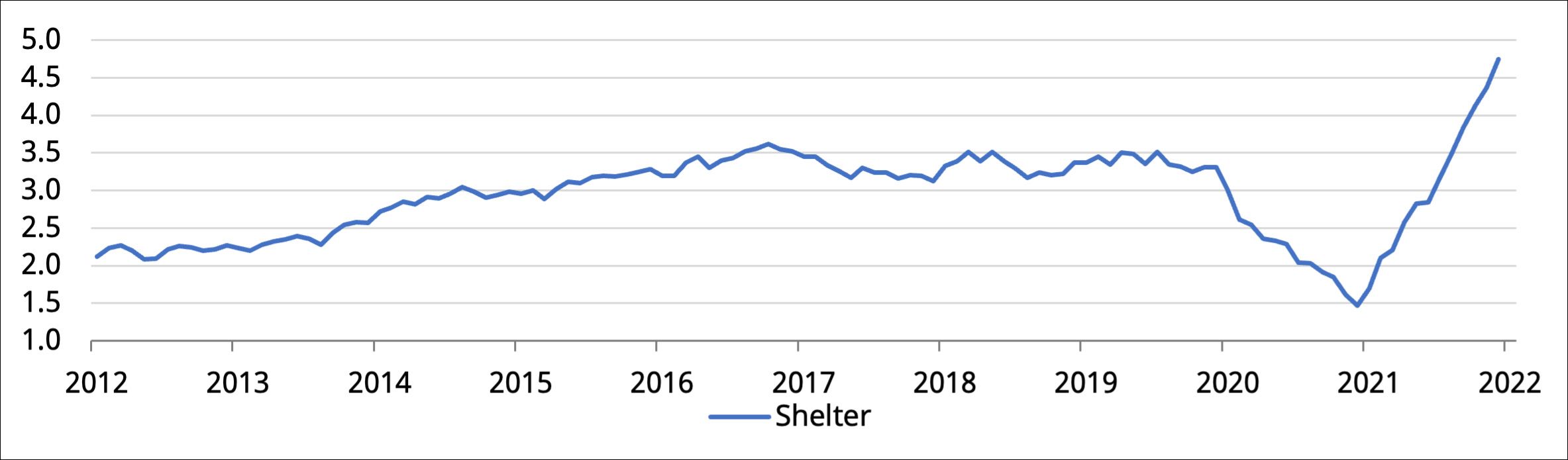

The chart below shows how dramatically the cost of housing in the US (labelled “shelter” by the CPI) has increased since the start of 2021. Owners of residential assets can generate a real return as their cash flows keep up with, and in some cases, exceed inflation levels.

Source: Refinitiv Datastream, Schroders, 2022

Source: Refinitiv Datastream, Schroders, 2022

And it is not just the residential sector that can provide protection against inflation.

Many leases across all types of sub-sectors have explicit commitments to rental increases (or escalators) tied to inflation.

In some instances, there are also leases with fixed escalators or rent reviews at specific times.

These all give investors the opportunity to ensure their income generates a real return – that is, one that is above inflation.

Historical protection against inflation

The essential nature of many property assets such as residential (everyone needs a place to live), healthcare (everyone gets sick at some point), or data centres (everyone communicates digitally), is one of the reasons why investors have historically been protected from inflation.

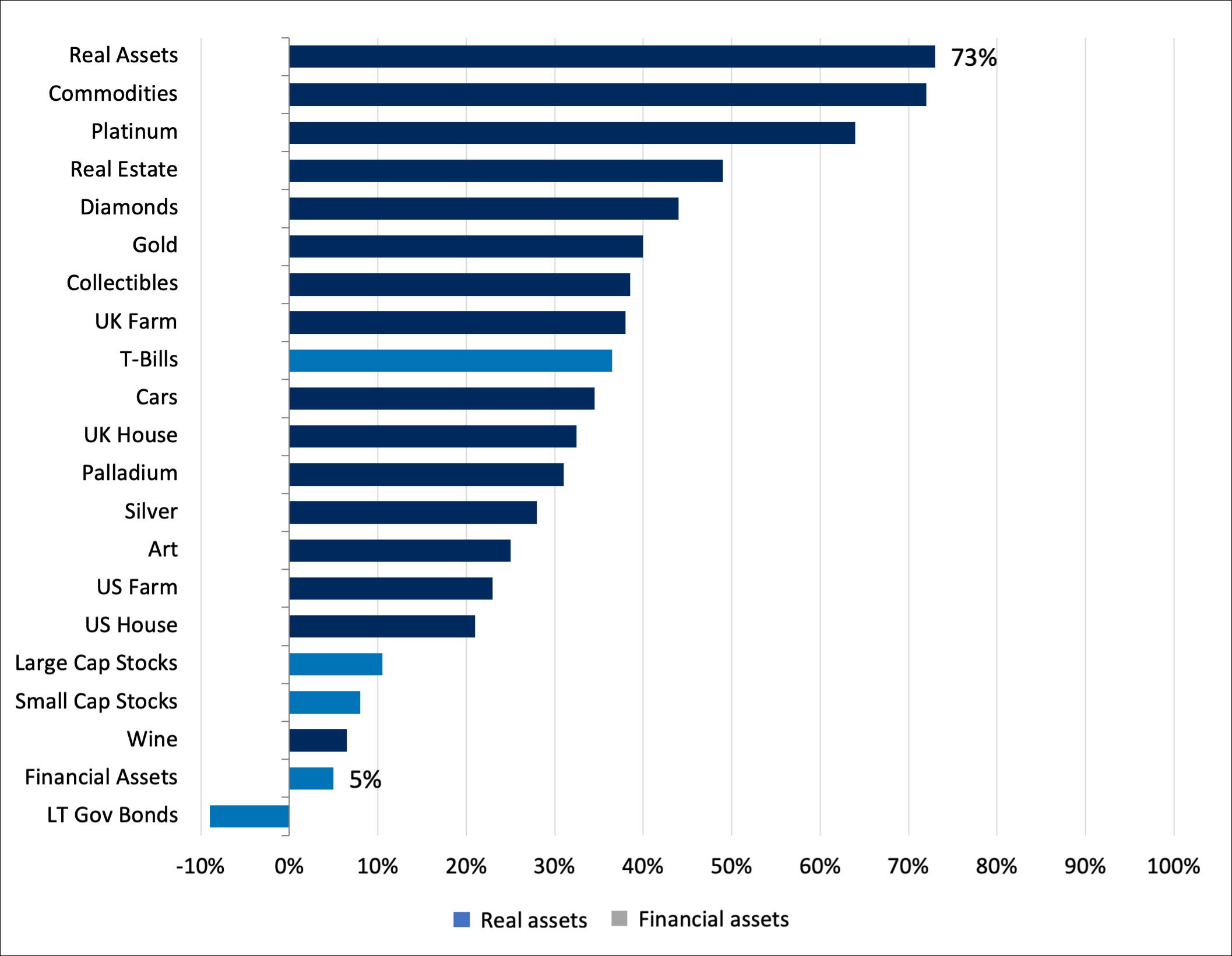

This is backed up by a study carried out by the Bank of America (see chart below) into the correlation of various asset classes with US CPI between 1950 and 2020.

It concluded that real assets are a hedge against inflation.

Source: BofA Global Investment Strategy, Global Financial Data, Bloomberg, United States Geological Survey, USDA, Shiller, Savills, ONS, Spaenjers, WWW International Diamond Consultants Ltd, ArtPrice.com, Historic Auto Group.Note: Real Assets calculated as the equally weighted average of commodities, real estate, and collectibles; Financial Assets calculated as the equally weighted average of large cap stocks and long-term government bonds.

Source: BofA Global Investment Strategy, Global Financial Data, Bloomberg, United States Geological Survey, USDA, Shiller, Savills, ONS, Spaenjers, WWW International Diamond Consultants Ltd, ArtPrice.com, Historic Auto Group.Note: Real Assets calculated as the equally weighted average of commodities, real estate, and collectibles; Financial Assets calculated as the equally weighted average of large cap stocks and long-term government bonds.

Choose your property assets carefully

The Covid-19 pandemic has accelerated a number of trends, such as e-commerce and working from home.

These long-term, structural issues have weakened the pricing power for owners of property assets such as retail and office space.

Consequently, the ability to pass on inflationary increases to tenants in these buildings is severely limited.

Low levels of demand and high amounts of supply are a toxic combination for any market.

We believe that certain sub-sectors will continue to experience challenging operating environments over the medium to long term.

Therefore, it has never been more important to select the right type of real estate to own.

How can investors achieve pricing power today?

Focusing on locations where economic growth is consistently the strongest means that investors can maximise their chances of being able to pass on increased costs to their tenants.

There are certain sub-sectors that are characterised by very low levels of supply.

For example, obtaining planning permission to build data centres, warehouses, self storage units or student accommodation in many cities can be incredibly difficult.

Yet the demand for these types of assets continues to grow.

The pricing power in certain sub-sectors is set to increase as the cost of raw materials reduces the amount of construction starts.

There are two key reasons for the lack of new property entering the market.

Firstly, the pandemic led to an initial slowing in new supply as construction sites were shut down. Secondly, dramatic increases in the cost of raw materials and supply bottlenecks have resulted in lower margins for developers.

While this is frustrating for developers, the silver lining is that it increases both the value and demand for existing assets.

Many investors worry about the impact rising interest rates will have on the real estate sector.

However, history demonstrates that this should not be a cause for concern.

At the start of the last two rate hiking cycles the global real estate investment trust (REIT) sector has finished with positive total returns.

Tom Walker is co-head of global listed real assets at Schroders

Important information: The views and opinions contained herein are those of Schroders' Global Cities Team, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. The data provider and issuer of the document shall have no liability in connection with the third-party data. The prospectus and/or schroders.com contains additional disclaimers which apply to third-party data. Regions/sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc, an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.